This Is What Integrated Wealth Management Looks Like

Our wealth management and financial planning services factor in tax planning, business income, and real estate holdings, so every decision reflects a coordinated view of your finances and long-term goals.

Planning for Individuals Balancing Complex Business or Personal Wealth

A Tax-Inclusive

Approach

Excessive tax drag can limit even strong financial and estate plans. We integrate tax planning into every wealth decision for business owners, real estate investors and HNW families so strategies reflect the true after-tax impact on long-term wealth.

Proactive

Communication

We do not disappear between annual reviews. Expect regular outreach, clear explanations, and ongoing conversations so tax planning, wealth management, and cash flow decisions stay aligned as your business, income, and family situation evolve.

Built For Businesses and Real Estate Investors

Our wealth management work is designed for business owners and real estate investors, coordinating wealth planning, tax planning for real estate families, estate planning, and CPA income tax planning so your entities and long-term goals stay aligned.

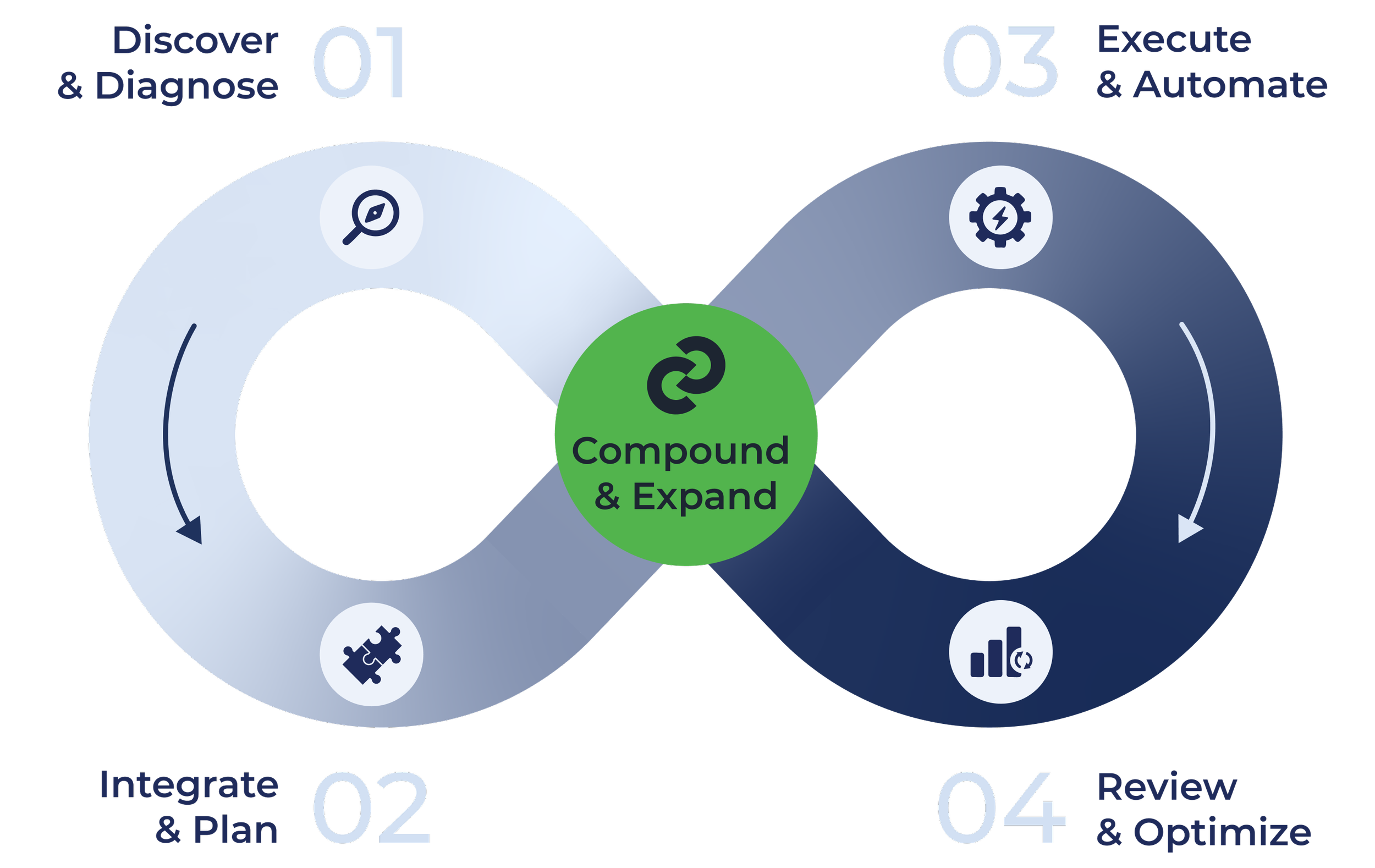

The Compound Process

The Result: A synchronized flywheel of tax planning, wealth management, accounting and business transition insight and execution, all coordinated by one advisory partner.

- Deep-dive intake on goals, entities, cash flow, real estate assets, and business interests for tax and financial planning.

- AI-powered bookkeeping clean-up so tax, accounting, and wealth decisions start from accurate, near-real-time data.

- One interdisciplinary team (tax, wealth, accounting, business advisory) builds a single, multi-year plan for.

- Entity structuring, tax maps, investment policy, and estate and succession planning are aligned on day one.

- AI handles reconciliations, data pulls, and rule-based alerts; advisors oversee and adjust integrated tax and wealth strategies.

- A 48-hour close target gives leadership “live” numbers for faster decisions.

- Quarterly strategy checkpoints + always-on chat/video access for ongoing tax planning and wealth guidance.

- Scenario modeling for new ventures, liquidity events, business exits, or family changes.

- Savings roll into investments; investments generate new planning opportunities for business owners and families.

- Trust and estate planning, philanthropy, and advanced strategies layer in as wealth and complexity scale.

Why Work With Compound for Wealth Management

Is there a wealth management firm that also does taxes? Yes. Compound Wealth is that firm.

By integrating wealth management with multi-year tax planning for business owners and real estate investors, we align every part of your financial life to work together efficiently.

The result? A coordinated wealth plan designed to fit your needs today and adapt to future transitions.

We understand that your wealth plan should not be static.

We believe in proactive communication to keep your tax and wealth strategy fluid and responsive as life and business evolve.

Wealth Management and Tax Planning FAQs

-

Our wealth management model is built around integrated tax and financial planning for business owners, real estate investors and HNW families and individuals. Our internal tax and wealth management teams collaborate closely with estate planning partners so each investment, distribution, or real estate move is evaluated for portfolio impact, current taxes, and long-term estate goals.

-

We combine wealth, tax, and estate planning because excessive tax drag can erode even a strong investment and estate strategy. By coordinating multi-year tax planning, real estate tax strategy, and estate documents, we can evaluate whether decisions made today support future after-tax wealth for you and your family.

-

Our planning-first approach helps clients see how everyday financial choices, from compensation structure to real estate purchases, affect long-term goals. We focus on financial planning for business owners and real estate families, modeling scenarios before implementation so decisions are grounded in cash flow, tax impact, and future flexibility.

-

Long-term relationships at Compound are built on proactive communication and ongoing planning, not once-a-year reviews. Clients can expect regular touchpoints, timely responses to questions, and continued guidance as businesses grow, liquidity events approach, or family needs change, much like working with a dedicated personal CFO.

Ready to Start Your Wealth Journey?

Learn how our integrated wealth management and multi-year tax planning can help you manage and grow wealth.