Strategic Multi-Year Tax Planning for Business Owners and Individuals

We specialize in helping you map out the next two to three years instead of just one tax season, from business tax planning to retirement tax planning and beyond.

Strategic Tax Planning for Business Owners and Individuals

Future-Focused Outlook

Strategy is our specialty. We build multi-year tax planning roadmaps for business owners and individuals, mapping income reduction strategies and key decisions two to three years before each major tax season.

Unmatched Communication

We don’t assume you know every tax rule. We educate clients on tax planning for high income earners, retirement tax planning, and business tax planning, explaining actions needed to manage overall tax liability.

Avoid Surprises in April

We enroll clients in ongoing tax planning so they can manage tax liability, avoid last-minute surprises in April, and improve year-round cash flow planning around bonuses, distributions, and other irregular income.

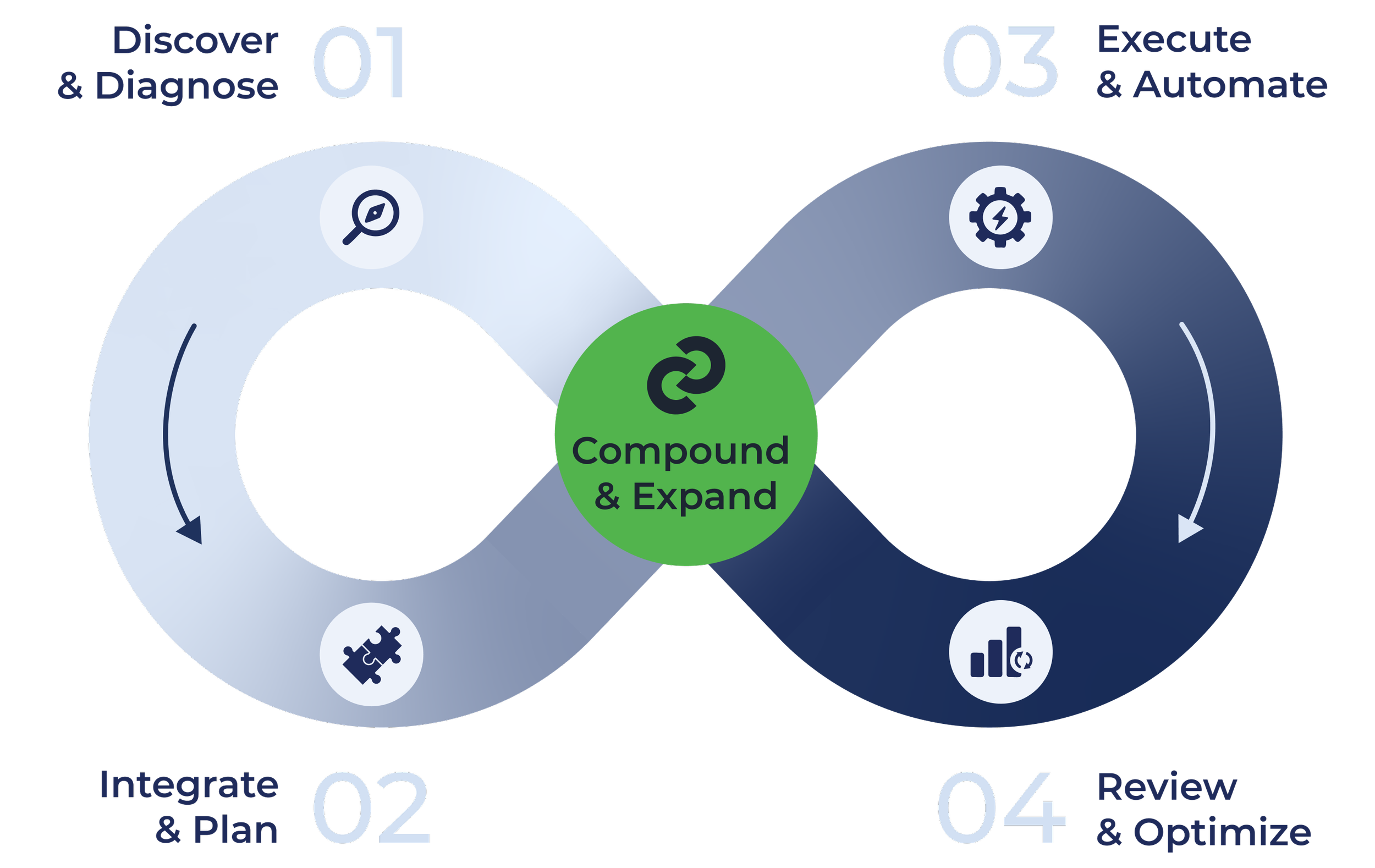

The Compound Process

The Result: A synchronized flywheel of tax planning, wealth management, accounting and business transition insight and execution, all coordinated by one advisory partner.

- Deep-dive intake on goals, entities, cash flow, real estate assets, and business interests for tax and financial planning.

- AI-powered bookkeeping clean-up so tax, accounting, and wealth decisions start from accurate, near-real-time data.

- One interdisciplinary team (tax, wealth, accounting, business advisory) builds a single, multi-year plan for.

- Entity structuring, tax maps, investment policy, and estate and succession planning are aligned on day one.

- AI handles reconciliations, data pulls, and rule-based alerts; advisors oversee and adjust integrated tax and wealth strategies.

- A 48-hour close target gives leadership “live” numbers for faster decisions.

- Quarterly strategy checkpoints + always-on chat/video access for ongoing tax planning and wealth guidance.

- Scenario modeling for new ventures, liquidity events, business exits, or family changes.

- Savings roll into investments; investments generate new planning opportunities for business owners and families.

- Trust and estate planning, philanthropy, and advanced strategies layer in as wealth and complexity scale.

Why Work With Compound for Tax Planning

When it comes to tax planning for business owners and high-income earners, strategy and communication are everything. We help you plan two to three years ahead with multi-year tax planning, not just for next April.

We understand that you likely are not steeped in the tax code. We work to ensure you receive not just a summary of new tax laws, but a practical tax planning roadmap for managing your liability.

The result? Better informed decisions.

Strategic Tax Planning FAQs

-

At Compound, strategic tax planning means multi-year tax planning that aligns with your business and personal goals. We look at business tax planning, retirement tax planning, income reduction strategies, and potential liquidity events, then coordinate those decisions with your broader financial and wealth strategy so today’s choices support future flexibility.

-

Traditional firms often focus on filing last year’s return. We focus on multi-year tax planning for business owners and high-income earners, creating and updating a forward-looking tax plan each year before tax season so clients can act two to three years ahead instead of reacting in April.

-

The strongest tax strategies are rarely built one year at a time. Multi-year planning lets us anticipate future income, investments, real estate moves, or a potential business sale, then structure decisions now to smooth tax liabilities, capture opportunities earlier, and reduce unwanted surprises as circumstances change.

-

Many people think tax planning is just an update on the latest tax laws. We instead focus on how decisions such as buying real estate, selling a business, purchasing equipment, changing accounting methods, or adjusting compensation can affect long-term tax savings and overall planning.

Ready for Better Tax Planning?

Reach out to our team to talk about multi-year tax planning, business tax planning, and retirement tax planning with Compound.