Integrated Tax and Accounting Services

for Modern Teams

Our accounting and payroll services coordinate with tax planning and business income. This approach helps owners and teams work with accurate numbers, timely reporting, and a clear view of cash flow and obligations.

Back-Office Accounting Built for Speed, Clarity, and Scale

Real-Time Financials

Real-time financial reporting reduces tax drag by showing how decisions affect cash flow, taxable income, and future planning. With near-current books, business owners can coordinate tax planning, wealth decisions, and exit planning instead of reacting after year-end.

AI-Native Efficiency

AI-native workflows handle reconciliations, payroll, and data pulls in the background, while our accounting and tax team stays proactive with check-ins, questions, and guidance so you are not only hearing from us once a year.

Actionable Insights

We combine tax planning for business owners, CPA income tax planning, and estate and wealth planning so real-time financials turn into specific next steps for saving on taxes, preparing for exits, and structuring long-term wealth.

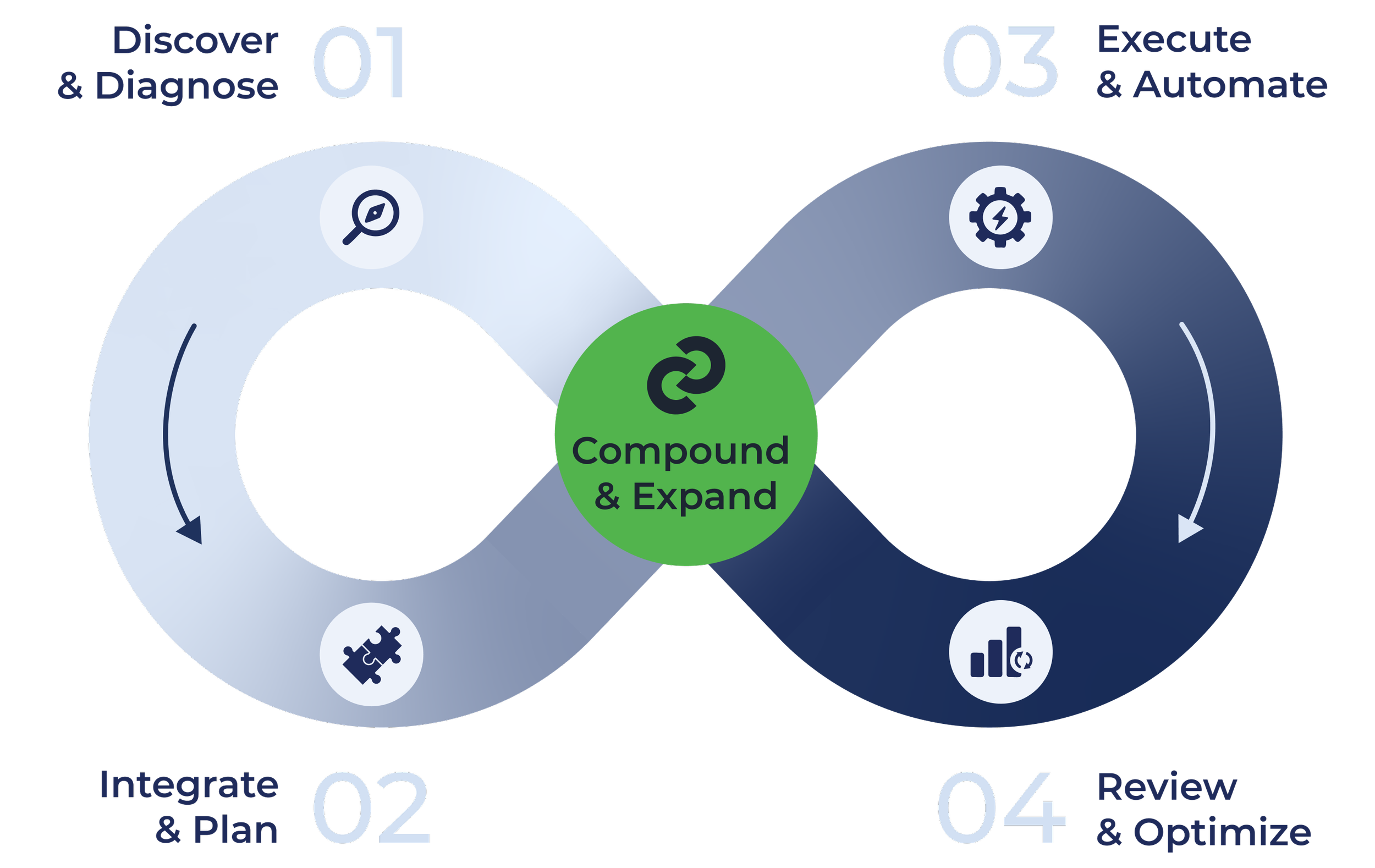

The Compound Process

The Result: A synchronized flywheel of tax planning, wealth management, accounting and business transition insight and execution, all coordinated by one advisory partner.

- Deep-dive intake on goals, entities, cash flow, real estate assets, and business interests for tax and financial planning.

- AI-powered bookkeeping clean-up so tax, accounting, and wealth decisions start from accurate, near-real-time data.

- One interdisciplinary team (tax, wealth, accounting, business advisory) builds a single, multi-year plan for.

- Entity structuring, tax maps, investment policy, and estate and succession planning are aligned on day one.

- AI handles reconciliations, data pulls, and rule-based alerts; advisors oversee and adjust integrated tax and wealth strategies.

- A 48-hour close target gives leadership “live” numbers for faster decisions.

- Quarterly strategy checkpoints + always-on chat/video access for ongoing tax planning and wealth guidance.

- Scenario modeling for new ventures, liquidity events, business exits, or family changes.

- Savings roll into investments; investments generate new planning opportunities for business owners and families.

- Trust and estate planning, philanthropy, and advanced strategies layer in as wealth and complexity scale.

Why Business Owners Choose Compound for Accounting and Payroll

Compound was built as an AI-native tax and accounting firm to deliver faster, smarter bookkeeping and payroll for growing private companies.

Real-time bookkeeping and accounting services powered by purpose-built AI infrastructure

Payroll and accounting workflows aligned for speed, accuracy, and clear cash flow visibility

In-house tax and accounting professionals who reduce the need for multiple outside vendors

The result? Clearer data, faster decisions, and more time for owners to focus on growth.

Accounting and Payroll Services FAQs

-

At Compound, accounting services are built around standardized, modern workflows rather than one-off customization. We advise business owners on updating accounting operations, payroll, and reporting so their systems are more efficient, scalable, and ready for AI-powered tax and accounting automation.

-

AI-powered accounting tools like Jenesys support near real-time financials, automating reconciliations, categorization, and data pulls so owners can see up-to-date books, monitor cash flow, and coordinate tax planning and payroll decisions without waiting for month-end closes.

-

Real-time or near-real-time financial data gives business owners current visibility into revenue, expenses, payroll, and cash reserves, which supports faster decisions, better tax planning for business owners, and fewer surprises when banks, buyers, or advisors ask for updated financial statements.

-

Our accounting and payroll services are built for growing small to mid-sized businesses, including service-based firms and real estate businesses that benefit from integrated bookkeeping, payroll, and tax planning, plus a single tax and accounting firm coordinating core back-office workflows.

Ready to Upgrade Your Accounting Services and Payroll?

Connect with our team to talk about AI-enabled accounting services, real-time bookkeeping, and payroll support for growing small and mid-sized businesses.