A Modern Tax, Wealth, and Accounting

Firm for Builders

Compound is an AI-native, integrated tax, wealth management, accounting, and business transition firm built to support business owners and families through every life and business stage. We keep it simple: the name “Compound” reflects our belief that coordinated tax, wealth, and business decisions made early create a stronger foundation for long-term success.

Why Compound Exists

We exist to bring tax planning, wealth management, accounting, and business transition services together for business owners, real estate investors, and private company leaders. Our mission is to provide integrated tax and financial planning for private company owners, and advisory support for private companies approaching a transition. We also help clients prepare for liquidity events, generational transitions, and long-term wealth planning so their tax strategy, business planning, and personal finances stay aligned over time.

How We Support You

Tax Planning and Preparation

Strategic, multi-year tax planning focused on income, deductions and timing to support better tax decisions this tax season and beyond.

Business Transition Advisory Services

We provide support for business owners preparing for liquidity events, combining exit planning advisory, due diligence guidance, and execution support.

Integrated Wealth Management

Financial planning that connects investments, business income, and tax outcomes, helping avoid unexpected tax results.

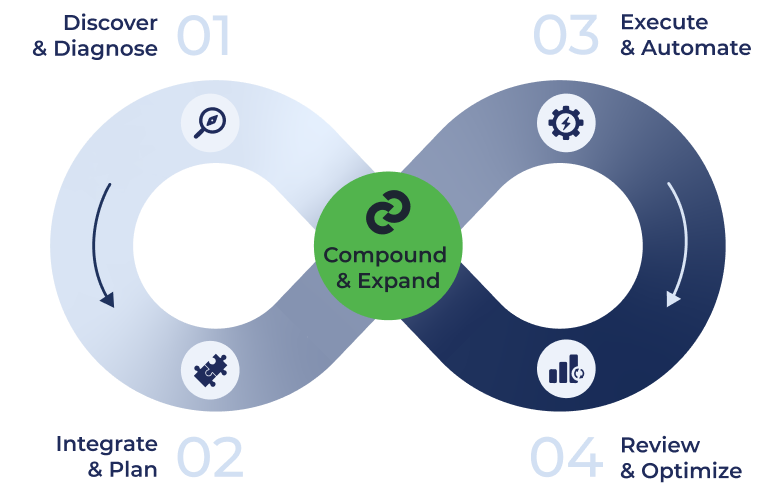

The Compound Process

The Result: A synchronized flywheel of tax planning, wealth management, accounting and business transition insight and execution, all coordinated by one advisory partner.

- Deep-dive intake on goals, entities, cash flow, real estate assets, and business interests for tax and financial planning.

- AI-powered bookkeeping clean-up so tax, accounting, and wealth decisions start from accurate, near-real-time data.

- One interdisciplinary team (tax, wealth, accounting, business advisory) builds a single, multi-year plan for.

- Entity structuring, tax maps, investment policy, and estate and succession planning are aligned on day one.

- AI handles reconciliations, data pulls, and rule-based alerts; advisors oversee and adjust integrated tax and wealth strategies.

- A 48-hour close target gives leadership “live” numbers for faster decisions.

- Quarterly strategy checkpoints + always-on chat/video access for ongoing tax planning and wealth guidance.

- Scenario modeling for new ventures, liquidity events, business exits, or family changes.

- Savings roll into investments; investments generate new planning opportunities for business owners and families.

- Trust and estate planning, philanthropy, and advanced strategies layer in as wealth and complexity scale.

The Team Behind Your Tax and Wealth Plan

Our advisory team unites tax planning, wealth management, accounting, and business transition services for business owners, real estate investors, private company leaders, high-net-worth individuals and families. You work with an in-house team of advisors experienced across these integrated disciplines.

Compound was built for individuals and families whose lives, taxes, and balance sheets are all tied together. We focus on integrated tax and wealth planning for business owners, real estate families, high-net-worth individuals and lower middle market companies that need more than one-off tax returns or generic portfolio management.

Our team brings experience in business exit planning, tax planning for business owners and individuals, and financial guidance for companies preparing for liquidity events or acquisitive growth. We pay attention to equity value creation, entity structure, and how real estate, compensation, and distributions show up on your actual tax bill.

Whether you are planning to sell in a few years, building first-generation real estate wealth or a private practice, or navigating founder-to-next-generation transitions, we work to connect tax strategy, wealth management, and accounting so decisions support both your business and your family over time.

Why Choose Compound for Tax and Wealth Planning?

Ready to Start Your Wealth Journey?

Reach out to our team to talk about integrated tax and wealth planning, business exit planning, and long-term strategies for business owners and families.