Venture Partner Services for Business Transition and Exit Planning

We support business owners selling a business in Wisconsin and beyond with business exit planning, tax planning before a business sale, and equity value advisory so liquidity events align with long-term wealth and integrated tax and wealth planning.

Next Generation Business Transition Planning

Pre-Transaction Value and Readiness Planning

We work with privately owned companies well before a sale is imminent to strengthen equity value and owner readiness. This includes business readiness planning, due diligence preparation, integrated tax and wealth considerations, and guidance around timing, valuation, and growth strategy decisions. Owners gain clarity on what buyers evaluate, what needs improvement, and how to position the business to operate successfully beyond the founder.

Transaction and Liquidity Event Advisory

For owners actively evaluating or executing a transaction, we provide steady financial and tax planning support throughout the process. This includes buy side and sell side guidance, offer and earnout analysis, tax planning before and during a sale, and coordination through due diligence so decisions remain informed, organized, and aligned with long term objectives.

Post-Transaction Wealth, Tax, and Family Planning

After a liquidity event, we help owners transition from operating wealth to stewarding it. This includes integrating tax strategy, wealth management, retirement planning, real estate considerations, and family planning into a coordinated long term framework that supports lifestyle goals, legacy priorities, and next generation planning.

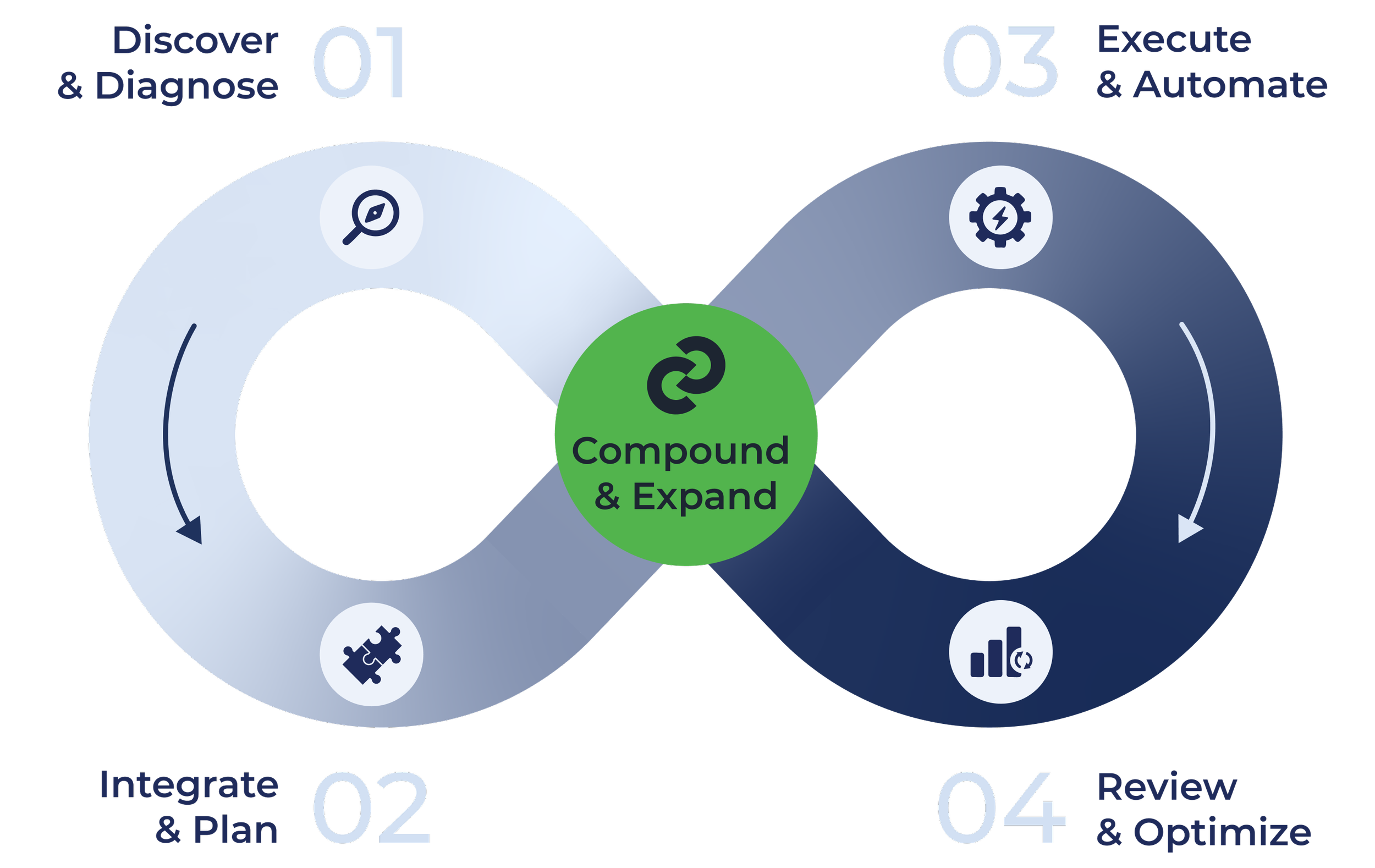

The Compound Process

The Result: A synchronized flywheel of tax planning, wealth management, and accounting insight and execution, all coordinated by one advisory partner.

- Deep-dive intake on goals, entities, cash flow, real estate assets, and business interests for tax and financial planning.

- AI-powered bookkeeping clean-up so tax, accounting, and wealth decisions start from accurate, near-real-time data.

- One interdisciplinary team (tax, wealth, accounting, business advisory) builds a single, multi-year plan for.

- Entity structuring, tax maps, investment policy, and estate and succession planning are aligned on day one.

- AI handles reconciliations, data pulls, and rule-based alerts; advisors oversee and adjust integrated tax and wealth strategies.

- A 48-hour close target gives leadership “live” numbers for faster decisions.

- Quarterly strategy checkpoints + always-on chat/video access for ongoing tax planning and wealth guidance.

- Scenario modeling for new ventures, liquidity events, business exits, or family changes.

- Savings roll into investments; investments generate new planning opportunities for business owners and families.

- Trust and estate planning, philanthropy, and advanced strategies layer in as wealth and complexity scale.

Why Compound?

Compound was built to help privately owned middle market companies navigate business exits and liquidity events with integrated tax, wealth, and transaction advisory.

Advisory support for selling a business in Wisconsin and beyond

Financial guidance for owners preparing for liquidity events and buyer due diligence

M&A-experienced advisors focused on equity value creation, not just closing a deal

The result? Better prepared financials, clearer offers, and a transition plan that supports your next chapter.

Business Transition Planning Questions for Private Company Owners

-

Ideally, planning begins several years before a potential sale. Compound Wealth works with owners early to assess readiness, improve financial reporting, and address buyer considerations over time. This allows space to strengthen equity value, align tax and wealth planning, and make thoughtful decisions around timing rather than reacting late in the process.

Additionally, we have built Compound with AI as the backbone. All of our processes have been formulated using AI tools. As other firms need to rework all of their workflows to adapt to the rise of AI, Compound is ahead of the curve.

-

Tax planning before a business sale can significantly influence after-tax proceeds. Compound Wealth coordinates accounting, tax strategy, and wealth planning to help owners evaluate deal structure, liquidity timing, and post sale financial implications, creating alignment between the transaction and long term personal and retirement goals.

-

Compound Wealth provides advisory guidance for due diligence planning by helping owners organize financials, anticipate buyer questions, and respond to information requests efficiently. Our team supports owners throughout the process so buyer conversations remain clear, organized, and focused as the transaction progresses.

-

Compound Wealth works with privately owned lower middle market companies, including construction, manufacturing, distribution, and real estate related businesses. We support owners preparing for liquidity events who want integrated tax, accounting, and wealth guidance before, during, and after a business transition.

Ready to Plan a Business Transition?

Connect with our team about business transition services, selling a business, and liquidity events.